IRS Form 2290 Instructions – The simplest guide to read and eFile HVUT Form 2290 for trucking businesses and self-employed truckers.

It doesn’t matter if you’re a regular filer or new to HVUT taxes, filing IRS Form 2290 is something that you have to be hands-on with if you want to stay on the road, especially if you’re in the trucking industry.

Businesses and truckers alike file Form 2290 with the IRS to report their vehicles with specific vehicle information, such as Vehicle Identification Number (VIN), Mileage Usage Limit (MUL), First Use Month (FUM), category of the vehicle, and so on.

If you’re a beginner or new to HVUT taxes, then this guide will be useful when reading the IRS 2290 Form. It will also help you get a little perspective on the subject.

Form 2290 Instructions: Before You Get Started

Here’s a little something to help you understand HVUT in a much simpler way. There are a variety of elements that make up an HVUT form. So, I’m going to break these elements down into comprehensive blocks so you understand their purpose and significance individually and severally.

What Is HVUT – Defining HVUT

HVUT is an acronym for IRS Form 2290. HVUT stands for Heavy Highway Vehicle Use Tax. HVUT tax applies to vehicles that weigh 55,000 pounds or more and utilize the highways for commercial, non-commercial, and agricultural purposes.

Here’s a link to the current revised version of the IRS Form 2290 Return 🡪 HVUT 2290

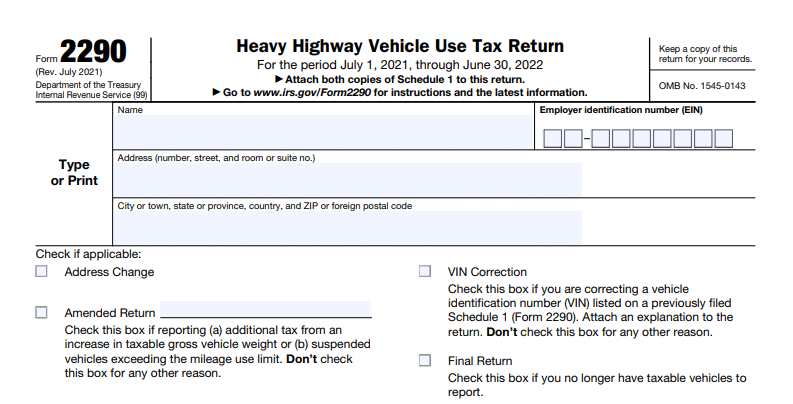

As you can see, the HVUT Form has several fields, including Name and Address. This is where you will have to enter your “Doing Business As” name or your business name, followed by your business address.

‘Check If Applicable’ On HVUT 2290 Return

This section of the form has 4 options, which each individually hold a unique purpose of filing as follows.

- Address Change

When you select this box, it means that you are filing the form to change the address of the business. The address you enter will be updated across your IRS records. You may be required to attach a proof of address to support this change.

- Amended Return

Select this box if you want to amend any of the information you have previously reported with Form 2290, such as:

- Increase in the taxable weight of the vehicle

- Exceeded mileage use limit

- VIN Correction

Select this box if you have previously reported an incorrect VIN on Form 2290. By filing this VIN Correction, you are helping the IRS track the vehicle’s history and related information.

- Final Return

Select this box if you no longer have any taxable vehicles to report.

Employer Identification Number (EIN)

Entering the Employer Identification Number (EIN) will help the IRS identify your business and the tax records associated with this EIN.

Vehicle Identification Number (VIN)

The VIN helps the IRS track the tax records associated with the vehicle’s identification number. It also helps the IRS track the ownership transfer and details of the vehicle owners.

Taxable Gross Weight

A vehicle has to weigh a minimum of 55,000 for the HVUT tax to be applicable. The taxable gross weight of the vehicle may vary at any time. It is important to enter the accurate weight so that the IRS can tax the vehicle appropriately.

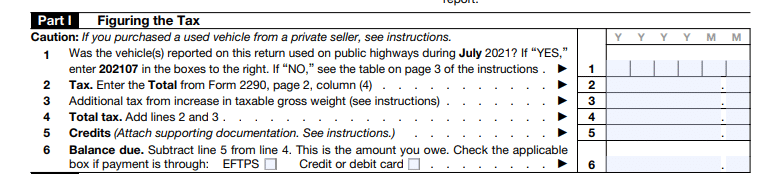

Form 2290 Part I – Figuring The Tax

Part I of the HVUT Form 2290 deals with calculating the actual tax you owe to the IRS.

This section requires you to have certain information by your side when entering the information. Inaccurate information entered will result in inaccurate tax figures, which leads to file rejections and penalties.

So, be conscious of the numbers you’re entering and make sure that you have the latest information available with you.

Line 1: Month Of First Use

Also known as First Use Month (FUM), the Month of First Use is a field on Form 2290 which requires you to enter the month in which the heavy vehicle was first used. For example, if you purchased a vehicle in January 2021 and started using the vehicle in February 2021, then you must enter February 2021 in the HVUT form.

Line 2: Tax

This field requires you to calculate and enter the total tax you owe to the IRS on all your vehicles. For this, you have to make use of the particulars available on Page 2 of the form and derive the total. The final amount must be entered in the ‘Tax’ field on Page 1.

Logging Vehicles

Logging vehicles are vehicles that are exclusively used for transporting forestry goods such as lumber, wood, paper, forage, and more. Logging vehicles also benefit from a 25% reduced tax liability as opposed to non-logging vehicles.

So, if you own a logging vehicle, your vehicle will be taxed at $75 on an average as opposed to $100 (for non-logging vehicles). In Form 2290, you have to enter the number of Logging Vehicles you own and calculate the tax.

For example; 10 Logging Vehicles x $75 = $750 🡪 your tax amount

You will be able to calculate as such on page 2 of Form 2290.

Used Vehicles

Enter the successive month after the purchase has been made.

For example, if you bought a used vehicle from a seller in June 2020, then you must enter July 2020 in your HVUT Form.

Further, the buyer is not liable to pay tax for the first use month (driving the vehicle from the seller’s location to the buyer’s location) of the tax period.

It is important to note that the title and change in ownership have to be documented and submitted to the IRS appropriately for careful verification. This would help the IRS to stop taxing the seller and start taxing the buyer. A copy of the seller’s stamped Schedule 1 would be useful in such a scenario.

Line 3: Increase In The Taxable Gross Weight Of A Vehicle

The weight of the vehicle can change due to increased load, which categorically changes the tax liability on that vehicle. When the gross taxable weight of the vehicle increases, you will have to pay additional tax for the increased weight.

The same must be reported with Form 2290 Amendment.

If the weight of the vehicle has increased in the current month, then the Amended return must be filed by the end of the successive month.

Line 4: Total Tax

Total Tax is the sum of the tax you owe on each vehicle and the additional tax you owe on every vehicle on which the gross taxable weight has increased.

So, the total of the tax you owe to the IRS on logging and non-logging vehicles + the additional tax you owe on vehicles for which the gross taxable weight has increased = Total Tax.

Line 5: Credit For Tax Paid

If you have previously claimed a refund from the IRS for excess tax paid, then such an amount will go here. If the amount has been credited to you, then such an amount will be deducted from the total tax you owe to the IRS.

If you do not have any refund claim credits, then leave this line empty.

Line 6: Balance Due

The total tax you owe (minus) the total credit you have claimed through refund claims is your total balance due.

You have to pay the balance due to the IRS.

For online tax payments, you can eFile Form 2290 with EZ2290, where you have several payment options, including debit/credit cards, digital wallets, and other fund transfer options.

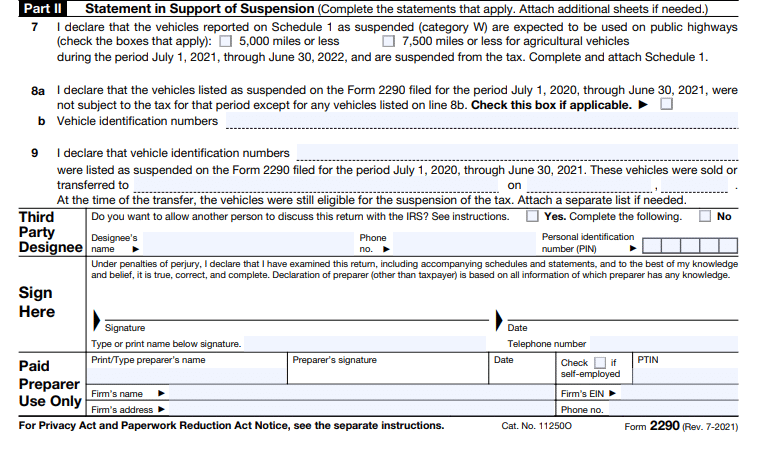

Form 2290 – Part II – Statement in Support Of Suspension

Part II of the 2290 HVUT Form helps you report vehicles that are suspended from tax, transfer of ownership, sale or purchase of the heavy vehicle, and related information. It is extremely useful in defining the current vehicle owner and claiming any credits for prepaid taxes.

Line 7: Tax-Suspended Vehicles

This section helps you report any vehicles (reported on this form) that are suspended from tax. Vehicle owners are not required to pay taxes for tax-suspended vehicles but have to file the forms for compliance purposes.

Line 8: Suspended Vehicles For The Last Year

Vehicles that have been suspended in the previous tax year must be reported in Form 2290 in the current tax year.

Even though you do not have to pay taxes for the suspended vehicle, it is essential to file and report the vehicle for compliance purposes. Further, vehicles that have more than one owner must be reported as well.

Line 9: Sale Or Transfer Of The Suspended Vehicle

If the suspended vehicle has been sold or transferred to a new buyer, then such a change in ownership of the vehicle must be reported with Form 2290.

When the ownership transfers to a new buyer, so do the tax liability. The seller has to file and pay taxes for the period until the date of ownership transfer.

Third Party Designee

A third party designee is an individual or an entity other than you and the IRS. The taxpayer (you) is in control of authorizing a certain individual or an entity to be a third party designee to discuss your tax reports with the IRS.

If you have authorized someone to communicate with the IRS on behalf of you regarding your tax reports, then you must furnish their name, personal identification number (PIN), and contact information. The IRS will reach out to them as and when required.

Signature – Sign The Form 2290

The taxpayer is required to sign in this field to confirm that they are aware of all the information reported in the form and its validity. By signing here, you are agreeing to comply with the IRS and their successive protocols if the information reported is found inaccurate or incomplete.

Paid Preparer Use Only

Businesses with large fleets hire paid preparers who take care of the tax forms and filings on behalf of the company. In such a case, the paid preparer must furnish the required information in this field, such as their name, contact information, name of their firm, contact information of the firm, and other information.

Even though the paid preparer is signing the return, the taxpayer is ultimately responsible for the accuracy and validity of the information reported in the returns.

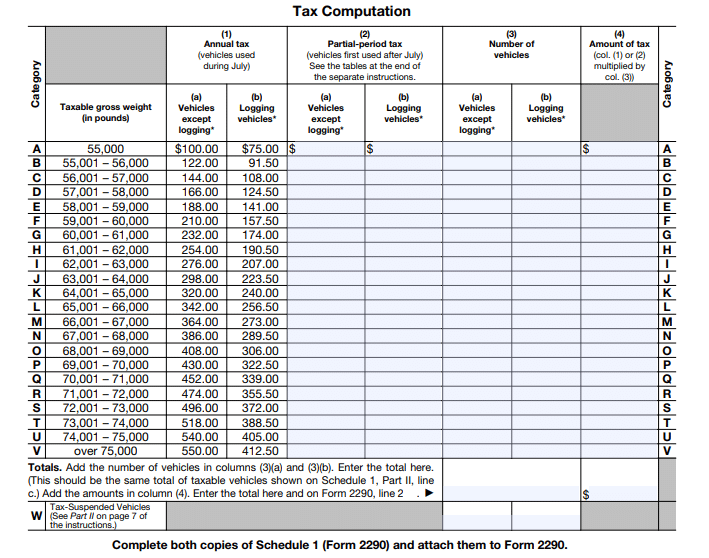

Page 2: Tax Computation Table On Form 2290

Taxable Gross Weight Categories (A-V)

Vehicles are categorized according to their taxable gross weight. When the weight of the vehicle changes, the category of the vehicle also changes, resulting in a change in tax liability.

The following table will help you understand the taxable gross weights and vehicle categories of Non-Logging Vehicles.

| Vehicle Category | Taxable Gross Weight (lbs) | Form 2290 Tax Amount (Approx) |

| A | 55,000 | $100.00 |

| B | 55,001 – 56,000 | $122.00 |

| C | 56,001 – 57,000 | $144.00 |

| D | 57,001 – 58,000 | $166.00 |

| E | 58,001 – 59,000 | $188.00 |

| F | 59,001 – 60,000 | $210.00 |

| G | 60,001 – 61,000 | $232.00 |

| H | 61,001 – 62,000 | $254.00 |

| I | 62,001 – 63,000 | $276.00 |

| J | 63,001 – 64,000 | $298.00 |

| K | 64,001 – 65,000 | $320.00 |

| L | 65,001 – 66,000 | $342.00 |

| M | 66,001 – 67,000 | $364.00 |

| N | 67,001 – 68,000 | $386.00 |

| O | 68,001 – 69,000 | $408.00 |

| P | 69,001 – 70,000 | $430.00 |

| Q | 70,001 – 71,000 | $452.00 |

| R | 71,001 – 72,000 | $474.00 |

| S | 72,001 – 73,000 | $496.00 |

| T | 73,001 – 74,000 | $518.00 |

| U | 74,001 – 75,000 | $540.00 |

| V | Over 75,000 | $550.00 |

The following table will help you understand the taxable gross weights and vehicle categories of Logging Vehicles.

| Vehicle Category | Taxable Gross Weight (lbs) | Form 2290 Tax Amount (Approx) |

| A | 55,000 | $75.00 |

| B | 55,001 – 56,000 | $91.50 |

| C | 56,001 – 57,000 | $108.00 |

| D | 57,001 – 58,000 | $124.50 |

| E | 58,001 – 59,000 | $141.00 |

| F | 59,001 – 60,000 | $157.50 |

| G | 60,001 – 61,000 | $174.00 |

| H | 61,001 – 62,000 | $190.50 |

| I | 62,001 – 63,000 | $207.00 |

| J | 63,001 – 64,000 | $223.50 |

| K | 64,001 – 65,000 | $240.00 |

| L | 65,001 – 66,000 | $256.50 |

| M | 66,001 – 67,000 | $273.00 |

| N | 67,001 – 68,000 | $289.50 |

| O | 68,001 – 69,000 | $306.00 |

| P | 69,001 – 70,000 | $322.50 |

| Q | 70,001 – 71,000 | $339.00 |

| R | 71,001 – 72,000 | $355.50 |

| S | 72,001 – 73,000 | $372.00 |

| T | 73,001 – 74,000 | $388.50 |

| U | 74,001 – 75,000 | $405.00 |

| V | Over 75,000 | $412.50 |

Tax Computation Columns

Tax computation columns allow the taxpayer to calculate, figure, and assess the tax amounts for each vehicle according to the period in which they were first used.

Column 1 – Annual Tax

Vehicles weighing 55,000 pounds or more that were used during July of the tax period are reported in this column. They are taxed for the entire tax year from July of the previous year to August of the current year.

Do note that the newly purchased vehicles used in July of the last year must be reported by August of last year. The vehicles will be taxed after the 2290s have been submitted in the previous year.

Column 2 – Partial-Period Tax

Vehicles that were first used after July must be reported in this column. This means that the vehicles are taxed partially. Enter the number of vehicles you own in the logging and non-logging columns to figure the tax amount.

Column 3 – Number Of Vehicles

Enter the total number of vehicles that you’re reporting from a particular category from A to V.

Column 4 – Amount Of Tax

To derive the tax amount, you must multiply the number of vehicles you own with the annual tax, as shown below.

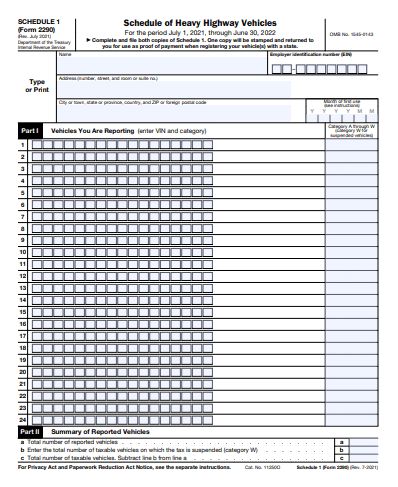

Schedule 1 of Form 2290 – Schedule 1 For Heavy Highway Vehicles

Each 2290 HVUT Form comes with 2 copies of Schedule 1. You will have to fill both copies of Schedule 1 in order to complete your 2290 Form. The additional, second copy of Schedule 1 is used by the IRS, in which they confirm the tax payment with an authorized stamp.

The stamped Schedule 1 is sent back to the taxpayer and must be documented to maintain a record of all your transactions with the IRS. It also comes in handy when you want to claim any tax credits from the IRS in the future.

Instructions To Complete Schedule 1 (Form 2290)

This is the easiest part of the 2290 Form filling yet the most important one as well. This is where businesses report their vehicles associated with vehicle identification numbers (VINs) and the category of the vehicles, respectively.

Form 2290 (Schedule 1) Business Details

This is where you will enter the business information, such as the name of your business, operational address, and the employer identification number (EIN) or TIN.

Part I – Vehicles You Are Reporting

Enter the vehicle identification numbers of the vehicles you’re reporting. Be sure to search and validate the VINs before you enter them here to avoid misreporting your VINs.

Part II – Summary Of Reported Vehicles

Enter the total number of vehicles you’re reporting on Row ‘a’.

Enter the total number of vehicles that have been suspended from tax on Row ‘b’.

Now, deduct Row ‘b’ from Row ‘a’ and you have the total number of taxable vehicles.

How To Pay The Form 2290 Tax

You can pay Form 2290 using different ways. EFTPS, Credit or Debit Cards, Check or Money Order, and Payment Voucher.

Electronic Federal Tax Payment System (EFTPS)

You can pay through EFTPS, where you will have to use your Social Security Number or TIN and the Personal Identification Number to log in to your account. It’s a 24×7 service and everyone who has the credentials can make use of this free service and pay their taxes online or by reaching out to the IRS telephonic support.

If you’re choosing this method, then you must select ‘EFTPS’ from the payment methods available on Line 6 of Form 2290.

Credit Or Debit Card Payment

You can also pay your taxes by opting to pay with your credit or debit cards. If you’re choosing this method, then you must select ‘Credit Or Debit Card’ from the payment methods available on Line 6 of Form 2290.

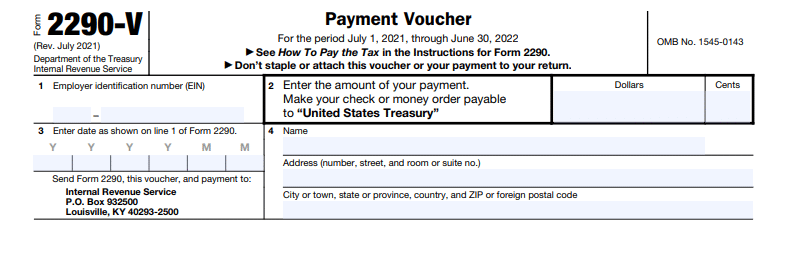

Check Or Money Order Using The Payment Voucher

If you plan on filing by paper, then you must fill out the Payment Voucher in Form 2290. You cannot send cash to pay your taxes. You will have to attach a check.

Form 2290-V – Payment Voucher

Furnish Form 2290-V with the required information, such as your EIN, the total tax amount, business name and address, date, and more. Do not attach cash with this voucher. Just attach your check, but do not staple it.

Send Payment Voucher with your 2290 HVUT Form and both copies of Schedule 1.

If you are eFiling, you do not need to file the Payment Voucher or the Schedule 1 as you would be choosing to make the tax payment online as well (it’s just more convenient that way).

Easily eFile 2020-2021 Form 2290 Online Using EZ2290

Alternatively, you can also pay the HVUT tax easily by registering with an IRS-authorized eFile provider like EZ2290. Register with your email and phone number and your account will be generated automatically.

eFile Form 2290 In 3 Simple Steps With EZ2290

- Create your business profile

- Select the 2290 Form you want to eFile

- Submit Form 2290 to the IRS

You can make the payment conveniently by choosing from the available payment options.

Benefits Of eFiling Form 2290 Online With EZ2290

- Easy and secure tax payments

- Free VIN Corrections

- Free Re-file for rejected returns

- Automatic tax calculations

- Penalty prevention regimes

- Accelerated reporting accuracy

- Live tax assistance

- eFile from any device from any location

In Conclusion

Filing HVUT Form 2290 is one of the most complex tasks if you’re not informed about the reporting procedures, but one of the easiest jobs if you have a simple guide (like this blog) by your side.

Be sure to validate the information you’re reporting in the form to avoid file rejections and penalties. IRS records every detail you have entered in the form to identify, track, and maintain your tax history. So, the more accurate your reports, the longer your trucks stay on the road.

Useful Link 🡪 IRS Instructions For Form 2290 – PDF

Keep coming back to this space for more updates.